Insights

Research, white papers and articles

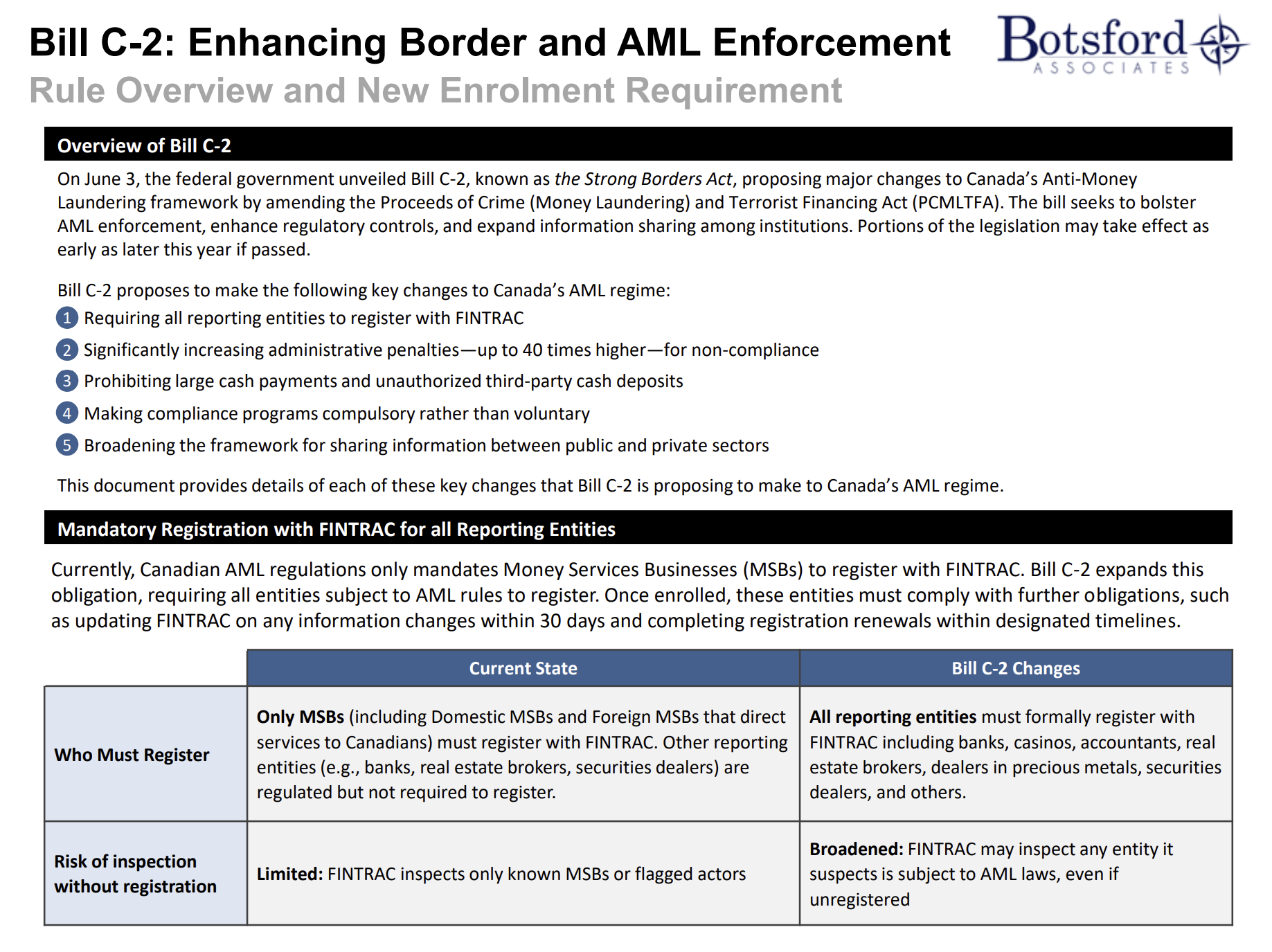

Bill C-2: Enhancing Border and AML Enforcement

September 2025

Rule Overview and New Enrolment Requirement, Mandatory Registration with FINTRAC for all Reporting Entities, Expanded Penalties for Non-Compliance, New Restrictions on Cash Transactions, Compliance Program Requirements, Expanded Information Sharing

Mergers & Acquisitions Integration (media clip!)

Deals make headlines.

Integration makes history.

Anyone can sign the deal.

Few can deliver the growth, retain the clients, and realize the synergies.

That’s where Botsford Associates comes in. We help financial services organizations turn M&A potential into measurable, lasting success — faster, smarter, better.

EU T+1 Settlement Readiness Roadmap

August 2025

On June 30, the EU T+1 Industry Committee released its High-Level Roadmap, setting the stage for a transition to T+1 securities settlement by October 11, 2027. See our Roadmap Purpose and Recommendations Overview, T+1 Operational Gating Events Timeline, and Financial Institutions T+1 Recommendations Dates and Details.

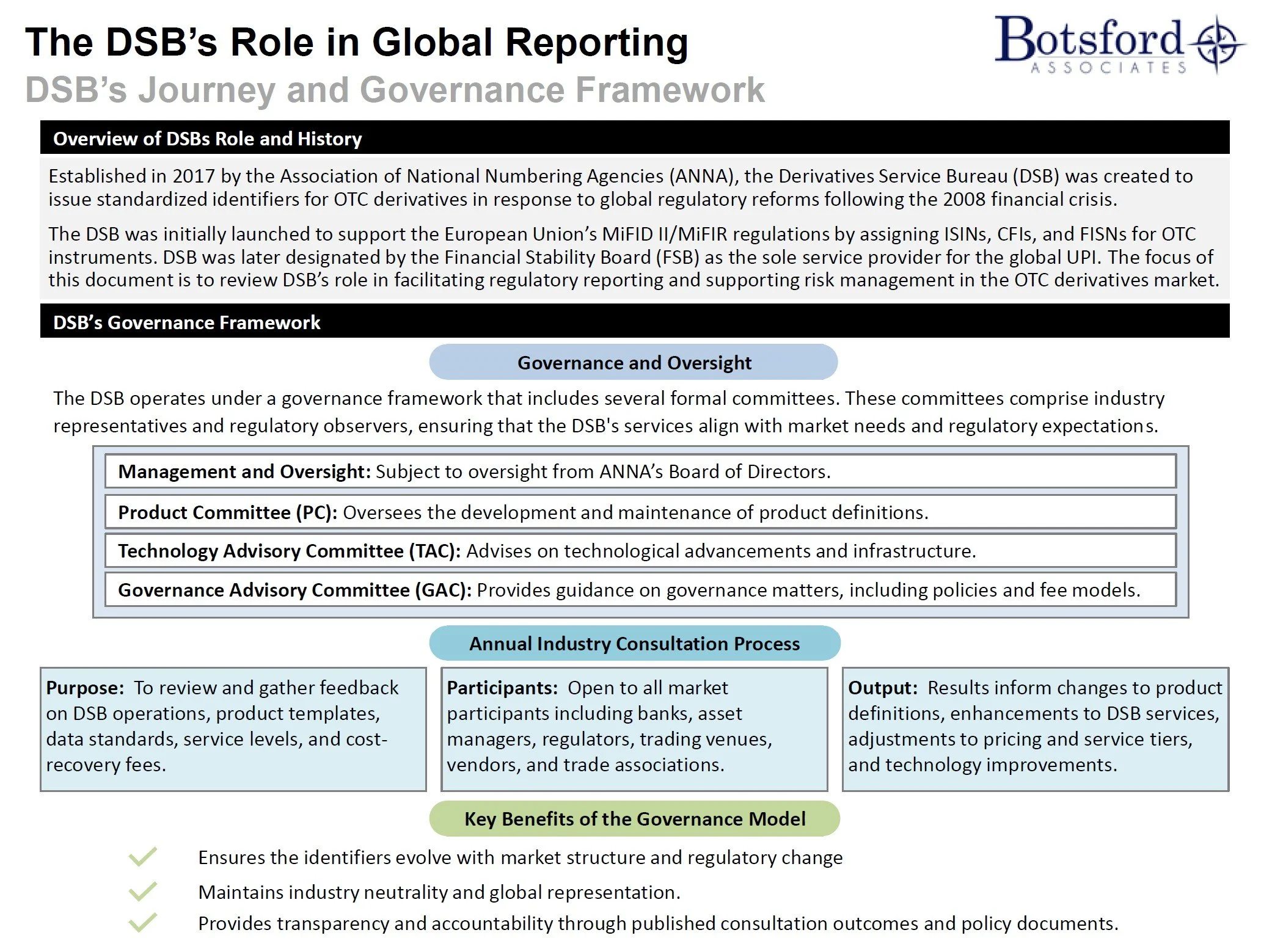

The DSB’s Role in Global Reporting

August 2025

Overview of the Derivatives Service Bureau (DSB) Role, History and Governance Framework, The DSB’s Role in Global Reporting including DSB Identifiers Driving OTC Market Transparency and Global Regulations Powered by DSB Identifiers

Botsford Annual Summer Outing (video)

July 2025

Last week, our team came together for our annual summer outing and what a fantastic day it was!

As a fully remote company, we deeply value opportunities to connect in person and strengthen our sense of team camaraderie

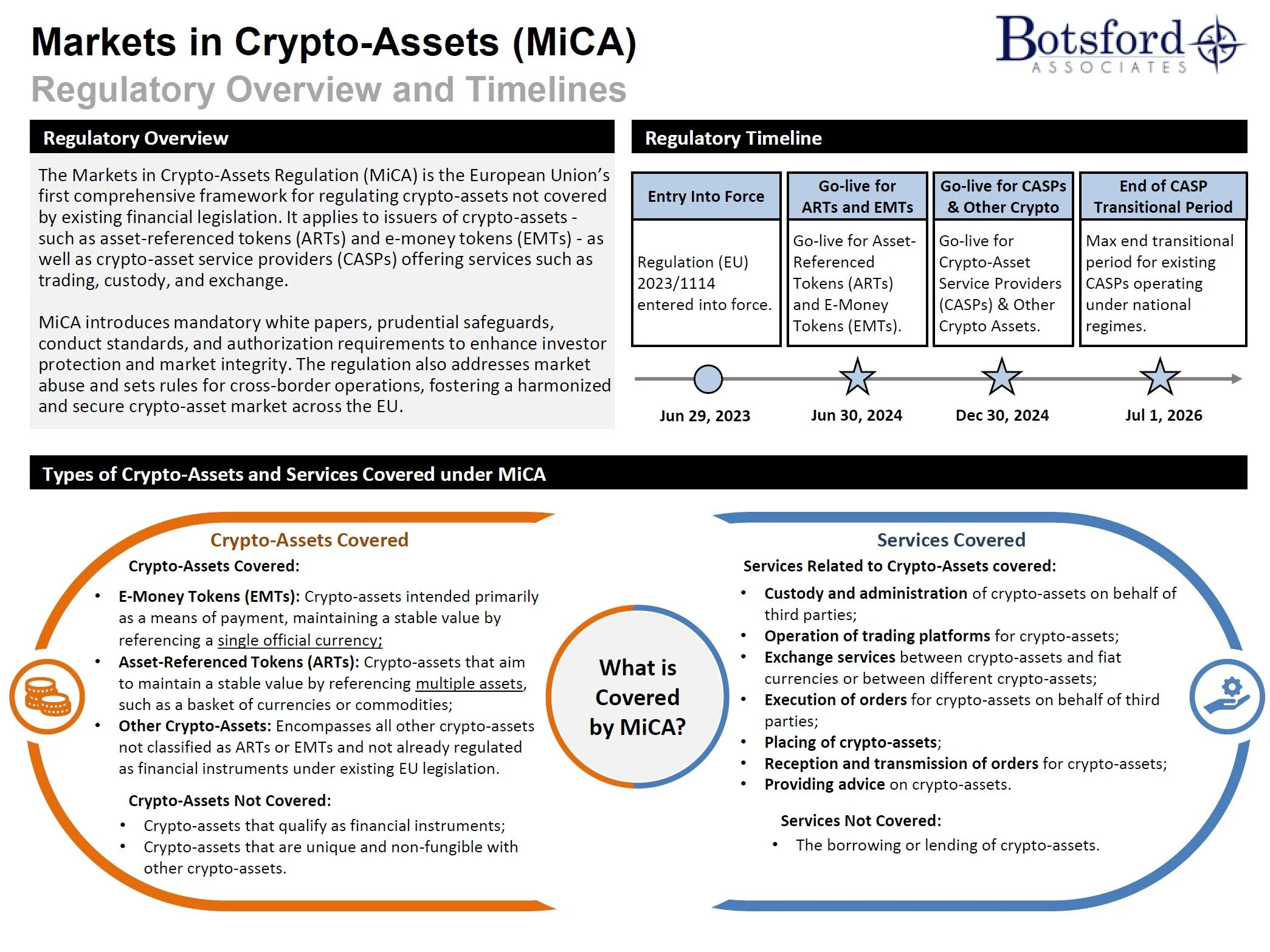

Markets in Crypto-Assets (MiCA)

July 2025

Regulatory Overview & Timeline, Types of Crypto-Assets and Services Covered under MiCA, Rules for Issuers of Crypto-Assets, Crypto-Asset Service Providers (CASPs) Regulatory Framework and Prevention of Market Abuse Involving Crypto-Assets

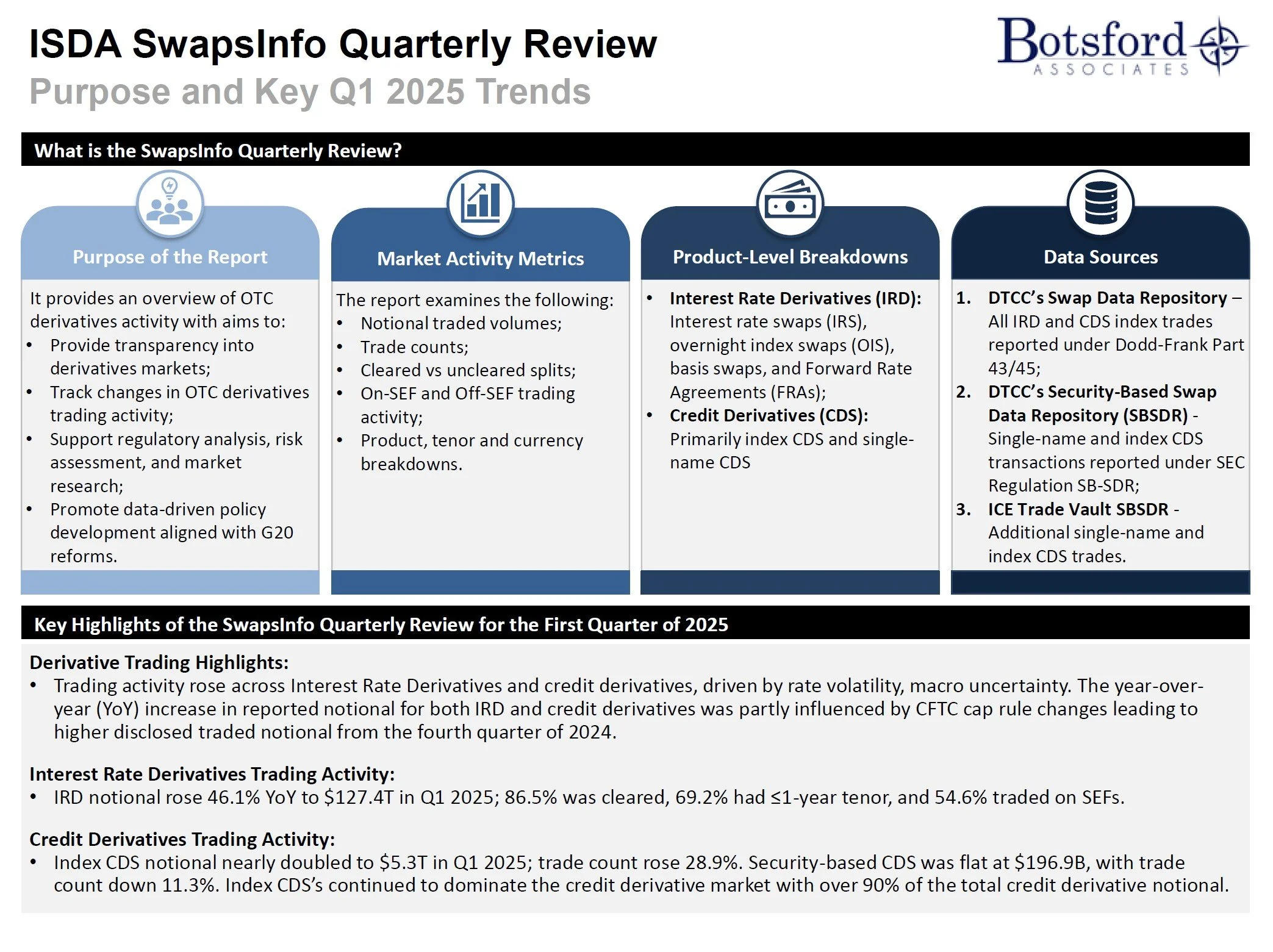

ISDA SwapsInfo Quarterly Review

July 2025

What is the SwapsInfo Quarterly Review? Key Highlights of the SwapsInfo Quarterly Review for the First Quarter of 2025, Key Highlights for Q1 2025: Interest Rate Derivatives, Key Highlights for Q1 2025: Credit Derivatives

Bay Street Games Update - Watch us in action! (Video)

June 2025

Earlier this month, the Botsford team had the incredible opportunity to take part in the Bay Street Games, hosted by Capitalize for Kids. It was an unforgettable experience, rallying for a cause that truly matters: supporting youth mental health.

Strengthening Canada's AML/ATF Framework

June 2025

Regulatory Overview and Timeline, Summary of the Key Changes, Trade, Information, and Ownership Reforms, Sectors Added to Canada’s AML/ATF Regime

2025 Financial Services Regulatory Outlook

May 2025

Key Regulatory Trends, Upcoming OTC Derivative Trade Reporting Rules: Canada - CSA, United States - CFTC, Hong Kong - HKMA and SFC, European Union - ESMA, Regulations with Upcoming Go-Live Dates across North America, Europe, and Asia, including Global Industry Initiatives

Supporting Youth Mental Health at the Bay Street Games!

May 2025

In recognition of Mental Health Month, we are thrilled to share that we will be participating in the Capitalize for Kids Bay Street Games on June 5th!

EU and UK Market Abuse Regulation (MAR)

May 2025

Regulation Overview and Timelines, Legislation Applicable to EU and UK MAR, What is in Scope of MAR, Market Abuse Offenses and Exemptions, Disclosure Requirements

CFTC Other Commodity Asset Class UPI Rules

April 2025

Regulation Overview, Key Objectives, Regulatory Timelines, Proposed Additional Reportable Data Fields, Geographical Masking Decision Tree

CFTC’s Operational Resilience Framework Rules

April 2025

Regulatory Overview and Expected Regulatory Timeline, Required Governance of the Operational Risk Framework, The Three Required Component Programs/ Plans: Information and Technology Security (ITS) Program, Third-Party Relationship Program, and Business Continuity and Disaster Recovery Plan, Other Required Elements within the ORF

Our Partnership with Capitalize for Kids and the Geneva Centre for Autism

March 2025

We partnered with Capitalize for Kids and the Geneva Centre for Autism in the development of a sustainable and equitable subsidy program that enhances access to essential autism services for families facing financial barriers.

South Africa G20 Trade Reporting

March 2025

Latest Developments to Achieve OTC Trade Reporting, Details of Strate being Licensed as a Trade Repository, Latest Developments and Next Steps for Trade Reporting in South Africa, Reporting Obligations in FSCA Conduct Standard

Increasing Clearing in U.S. Treasuries Regulation

March 2025

Regulatory Overview and Timelines, Summary of the Four Rules Being Amended, Details of SEC Rule Requirements and Definition of “Eligible Secondary Market Transactions”, Summary of DTCC Proposals to Modify the GSD Rules

OFR SFT-2 Reporting

March 2025

Regulatory Overview and Timelines, Who Needs to Report: Reporting Thresholds, Delegation of Reporting Responsibilities, Reporting Instructions for Covered Reporters

Insights from the Canadian RegTech Association’s (CRTA) Derivatives Forum

February 2025

Our Regulatory Advisory team attended the CRTA Derivatives Forum at S&P Global. The event featured insightful discussions with industry leaders tackling key regulatory challenges, particularly the CSA Rewrite and evolving global reporting mandates.

EU’s Transition to T+1 Securities Settlement

February 2025

Recent Developments for EU’s Transition to T+1, Product Types In-Scope of T+1, Benefits of Transitioning to T+1 Settlement, Expected Regulatory Timelines, Most Affected Areas of Impact for Firms, Implementation Timeline and Activities